Do you need health coverage?

North Dakota Navigators can help you find and enroll in health insurance. Our assisters are local, unbiased, and helping to break down barriers to care. We are trained to understand the details so that you don’t have to, making the enrollment process easier and teaching you how health insurance works. We want all North Dakotans to have better access to healthcare.

What Does a Health Insurance Plan Cover?

Healthcare reform has improved and streamlined what all health insurance plans must cover.

Most health insurance plans cover ten essential health benefits:

- Outpatient care (medical treatment received without being admitted to a hospital).

- Emergency services.

- Hospitalization (including surgery and overnight stays).

- Maternity, pregnancy, and newborn care.

- Mental and behavioral health care, including substance use disorder.

- Prescription drugs.

- Rehabilitative and habilitative services and devices (services and devices that help patients with injuries, disabilities, or chronic conditions gain or recover mental and physical skills).

- Lab services.

- Preventive care, wellness services, and chronic disease management.

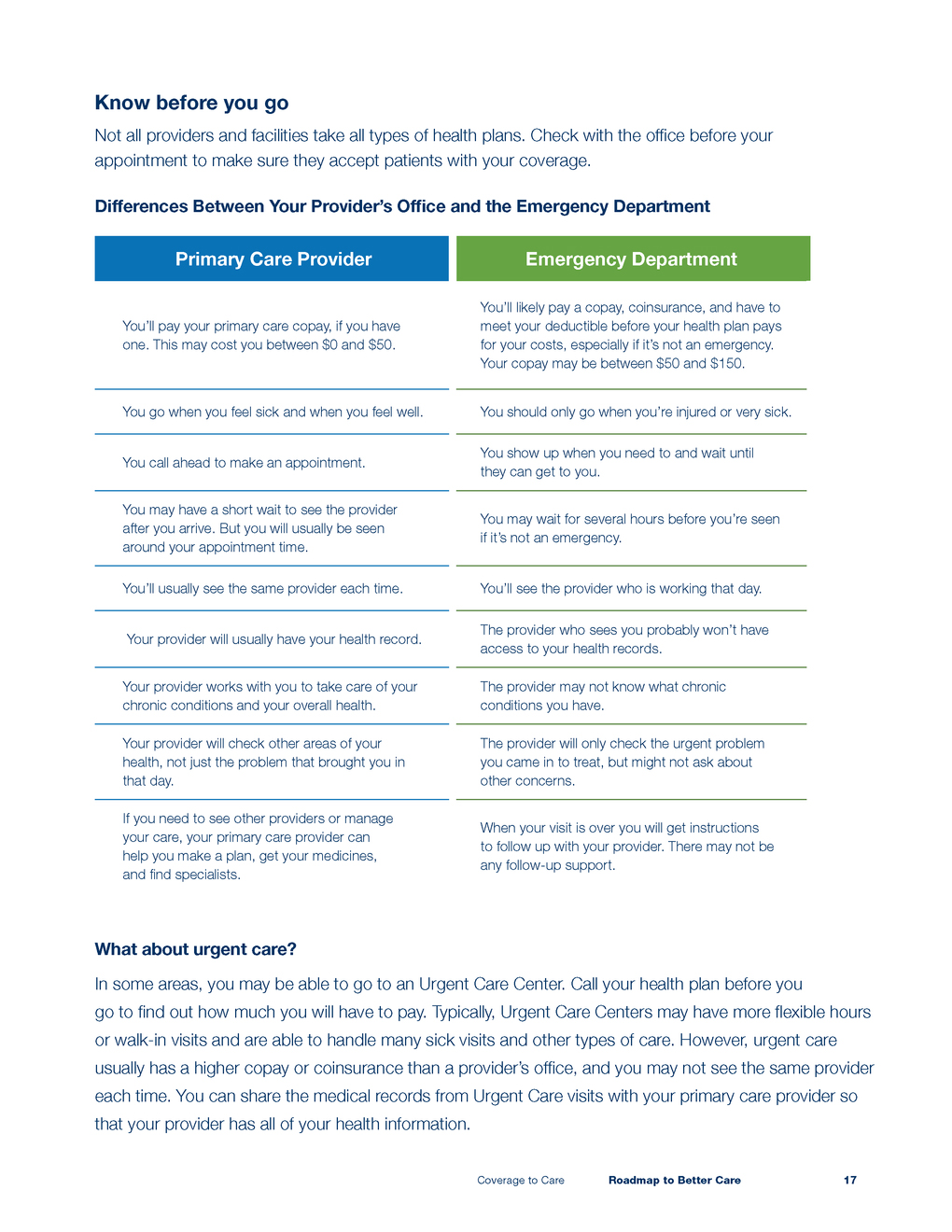

Common Health Insurance Terms

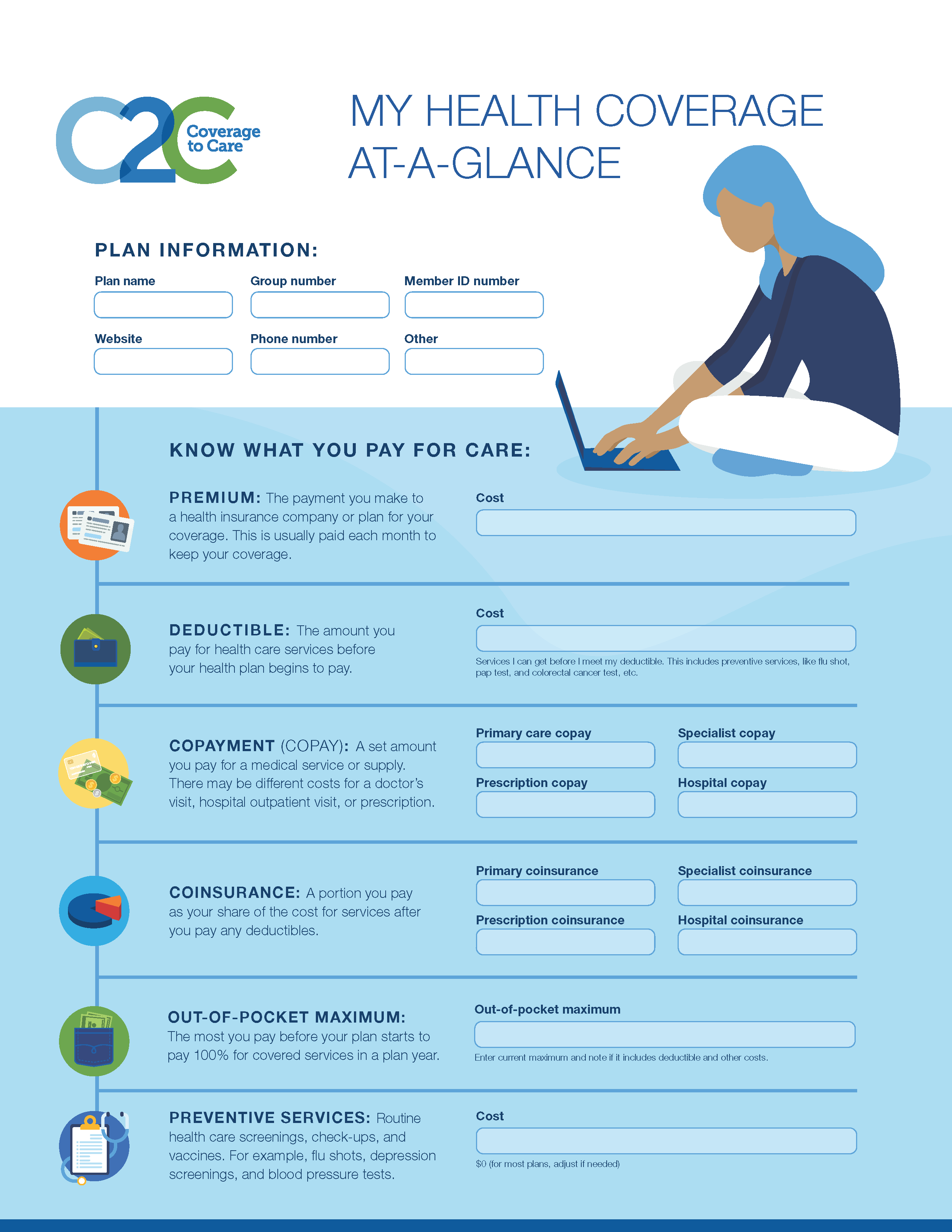

Premium

The payment you make to a health insurance company or plan for your coverage. This is usually paid each month to keep your coverage.

Deductible

The amount you pay for health care services before your health plan begins

to pay. Costs for certain preventive care, like annual doctor visits and some

prescriptions, are usually covered before paying your deductible.

Copayment (Copay)

A set amount you pay for a medical service or supply. There may be different

costs for a doctor’s visit, hospital outpatient visit, or prescription.

Coinsurance

A percentage of your medical bill that you pay as your share of cost for

services. Coinsurance kicks in after you pay your deductible.

Out-of-Pocket Maximum

The most you pay before your plan starts to pay 100% for covered services in a

plan year.

Preventive Services

Routine health care screenings, check-ups, and vaccines. For example, flu shots, depression screenings, and blood pressure tests. Costs for preventive care are often covered by your plan, before your deductible is met.

Premium Tax Credits

A tax credit you can use to lower your monthly premium on a Markeplace plan. Your tax credit is based on your income estimates and household size.

Tax Household

The taxpayer(s) and any individuals who are claimed as dependents on one federal income tax return. A tax household may include a spouse and/or children or adult dependents.

For more information about affordable healthcare plans or to request enrollment assistance, call us at 1-800-233-1737

or locally at 701-858-3580.

You can also email us at: NDNavigators@MinotStateU.edu

Health Insurance Marketplace

This grant is supported by the Centers for Medicare and Medicaid Services (CMS) of the U.S. Department of Health and Human Services (HHS) as part of a financial assistance award totaling $125,000 with 100 percent funded by CMS/HHS. The contents are those of the author(s) and do not necessarily represent the official views of, nor an endorsement, by CMS/HHS or the U.S. Government.